I wasn’t surprised by The Republic’s recent findings that during the 2015-16 school year, the vast majority of funding ($20.6 million) for vouchers was taken from public schools rated A or B, but only $6.3 million was taken from schools rated C or D. I’d previously seen a statistic that in 2012, about 92 percent of students taking advantage of the voucher (Empowerment Scholarship Account) program would have attended private schools anyway regardless of voucher availability. Let’s face it; this was never about helping the poor, disadvantaged minority child. The reality is that vouchers were never for poorer Arizonans who can’t cover the average private-school tuition costs of $10,421 when a voucher provides only $5,200.

And yet, the AZ Legislature is pushing two bills to fully open the floodgates on voucher availability, making every student in Arizona eligible for vouchers for homeschooling, tutoring, private school, or to save for college. This, despite the fact that there is little accountability in the program. Yes, recipients must provide quarterly reports of their spending, but DOE staffing for oversight is reportedly insufficient and the schooling options that vouchers pay for have no responsibility for reporting any kind of results. The taxpayer then, has no way to determine return on investment.

Here’s where I start to get confused. The GOP nay, Teapublican-led Arizona Legislature, loves to tout the need for accountability of taxpayer dollars. They are great however, at picking and choosing their targets for applying this accountability. [Please read on, this post isn’t really about vouchers.]

In 2015 for example, Representative Mark Finchem, R-LD11, basically accused both the Phoenix Union High School (PUHSD) and Tucson Unified (TUSD) school districts of using desegregation (deseg) funding for purposes other than what they were intended for. TUSD Superintendent H.T. Sanchez said he was not aware of any misuse, citing the fact that there is a strict review process for every deseg dollar spent. In fact, oversight of this funding is provided by the plaintiffs in a deseg suit against the district, the DOJ, a federal judge and the special master, a deseg expert overseeing the district’s efforts all get to weight in on how deseg funds can be used. Finchem though was undeterred and demanded forensic audits that the schools would have to pay for because “these are taxpayer dollars and we want to make sure those dollars are being spent wisely, that they’re not being misappropriated. And I think that’s an obligation this body has to see to it that those dollars are spent that way.”

Fortunately, SB 1120 failed. Senator Steve Farley, D-LD9, who had a child in TUSD, said, “Finchem represents no part of the Tucson Unified School District.” Finchem never took the time to discuss the issue first with Sanchez, meet with district officials or review audits already done according to Farley.

So, why don’t AZ Legislators care about accountability when it comes to vouchers, but are all over it when it comes to desegregation funds? Could it just have something to do with the socio-economic status and color of most voucher (private school) students versus those who are beneficiaries of deseg funds? Just sayin’…

I must admit I hadn’t really taken the time to learn the details about deseg funding (my district doesn’t get any) until a recent email exchange with Representative Vince Leach, R-LD11. In his email, he intimated that “districts continue to violate civil rights after billions of dollars have been spent to fix the problem” and asked, “Where is the accountability in that?” Again, that whole accountability thing. Yet, when I asked him to please vote no on the voucher expansion, citing in part the lack of accountability, he said “I think you know I am going to vote for them.”

So yes, I took the time to learn more about desegregation funding. The issue dates back to at least 1974 when two families filed separate lawsuits against TUSD and the court found TUSD “had acted with segregative intent” and failed to fix the problem. In 1979, the U.S. Department of Education’s Office for Civil Rights (OCR) launched an investigation against PUHSD and a lawsuit was filed in 1982 for allegedly engaging in segregation practices. Problems were also found in the Tempe Elementary School District to include deliberately segregating minority and non-English speaking students, assigning minority teachers to the district’s poorest schools and placing a disproportionate number of English language learners in special education classrooms. Schools in wealthier parts of the District also had full-day kindergarten, nurses and librarians, but the others did not.

In 1985, Arizona enacted legislation to allow districts under federal court orders or OCR agreements to bring racial and ethnic balance to their schools and provide equal access to high quality education, to levy property taxes above their revenue control limit. As a result, those districts were able to levy a limited amount of higher local property taxes without voter approval. Although there were some problems along the way, in 2005, PUHSD gained “unitary status” followed by TUSD in 2009. This status meant that these districts had formally fulfilled their desegregation court order. Plaintiffs in the TUSD suit disagreed the problem was fixed, filed an appeal of the District’s unitary status designation and in 2011; the Appeals Court reversed the decision and appointed a highly paid special master (in Massachusetts) to help TUSD develop a new “road map.” This road map outlines required activities including student assignment, transportation, faculty and staff assignment, quality of education, discipline, family engagement, access to facilities and technology and transparency and accountability.

There are now 19 school districts with almost 250,000 students (about 23% of the total) around Arizona that receive $211 million for racial and ethnic discrimination remediation (unchanged since 2009.) Since 1986, the total comes to $4.3 billion, with 97 percent going to Phoenix and Tucson Schools. Only PUHSD and TUSD actually receive “desegregation funding”, the other 16 districts have administrative agreements with OCR. Two bills in the AZ Legislature, seek to reduce and eventually eliminate all this funding (within 5 years for those with OCR agreements and 10 years for those in unitary status.) SB 1125 (a follow-on to last session’s unsuccessful 1371), sponsored by AZ Senator Debbie Lesko, R-LD21, passed by the Senate Finance committee on 2/11/16 and claims state property tax rate caps require the general fund to make up some $23 million in 2015 in desegregation funding garnered at the local level. HB 2401 sponsored by Representatives Vince Leach and Mark Finchem is a companion bill which has been retained on the calendar as of 2/23/16.

Of her bill, Lesko said “That’s money from all over the state that shouldn’t just go to a couple districts.” She thinks that rather then relying on deseg funding, districts should ask voters to approve budget overrides. According to the Senate Fact Sheet for SB1125 however, although the state funded this “cap gap” through FY 2015, the Legislature has now capped the state’s cost of the 1 percent cap program to $1 million per county, i.e., the state passed on a portion of the cost for the gap to the counties (who must then pass these costs on to the taxpayer.) Irrespective of the caps however, affected districts contend they would be violating a federal agreement and a lawsuit will ensue if the funding is discontinued. Additionally, according to a recent analysis by The Republic, districts receiving desegregation funding did not spend more per pupil than all others in 2014. This is because there are many different funding sources for schools including varying amounts of federal dollars, bonds and overrides.

For PUHSD, the largest in the state with over 27,000 students, the loss of deseg funding would translate to about $53 million and would require closing four high schools with a loss of 702 teaching and staff jobs (estimates put the state-wide loss of jobs at about 2,500.) The superintendent, Dr. Chad Gestson, says, “The proposed elimination of desegregation funding is simply a huge tax cut on the backs of our poorest students.” He goes on to say that the ramifications go beyond public education and will affect property values, crime rates, reduced tax base, more burden on the city, county and state and a lower quality of life. Superintendent Robbie Koerperich of Holbrook Unified School District says “we all deserve it…we [shouldn’t] bring Holbrook [down] to the same level as similar school districts, but we should fund the other districts to bring them up.”

Proponents of the funding however say the results speak for themselves with the graduation rate at PUHSD at 80 percent up from 55 percent 15 years ago. Same thing with dropout rates that went from 15 percent over 20 years ago to 3.4 percent today. The Districts grads are also earning more scholarships for college than only six years ago, $50 million now, versus $13 million then.

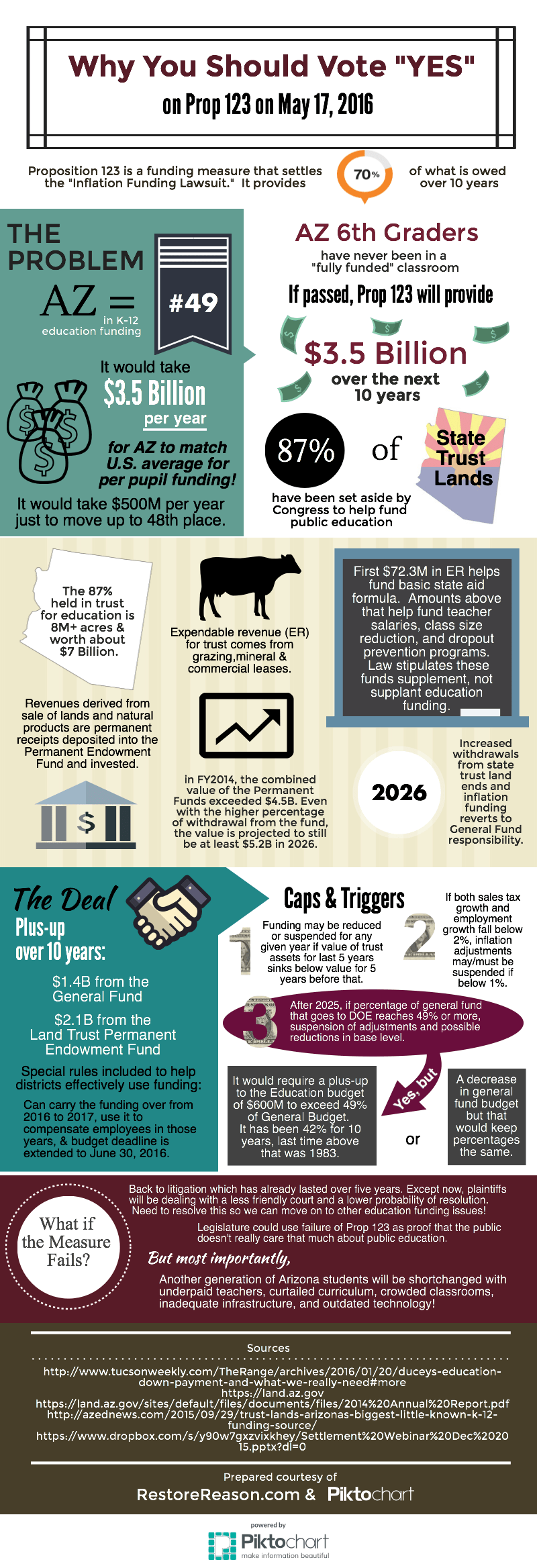

The $211 million currently spent in deseg funding works out to an average of $844 per student. The question we should be asking isn’t “is it unfair for the 19 districts under deseg orders or with OCR agreements to receive this funding”, but what is the appropriate level of funding for all our students. Arizona k-12 education saw the highest cuts in per pupil funding in the Nation from 2008 to 2014 and to move up to even 45th place, we would need to spend $1 billion more, or almost $950 per pupil. Of course, other than the badly needed Prop 123 monies, our Legislature isn’t talking about education plus-ups, only cuts. (Sorry, but the recent restoration of all but $2 million of JTED funding doesn’t count, that was just about rectifying the bad decision made in last year’s budget.)

To the Arizona Legislature I say, the voters are waking up to your pretension that you give a damn about All Arizona’s children. To the voters, I say NOTHING speaks louder than your vote.